Epiq Launches New Bankruptcy Analytics Platform

- General

First-ever bankruptcy market analytics platform with daily updates and insights from the industry’s most comprehensive filing data

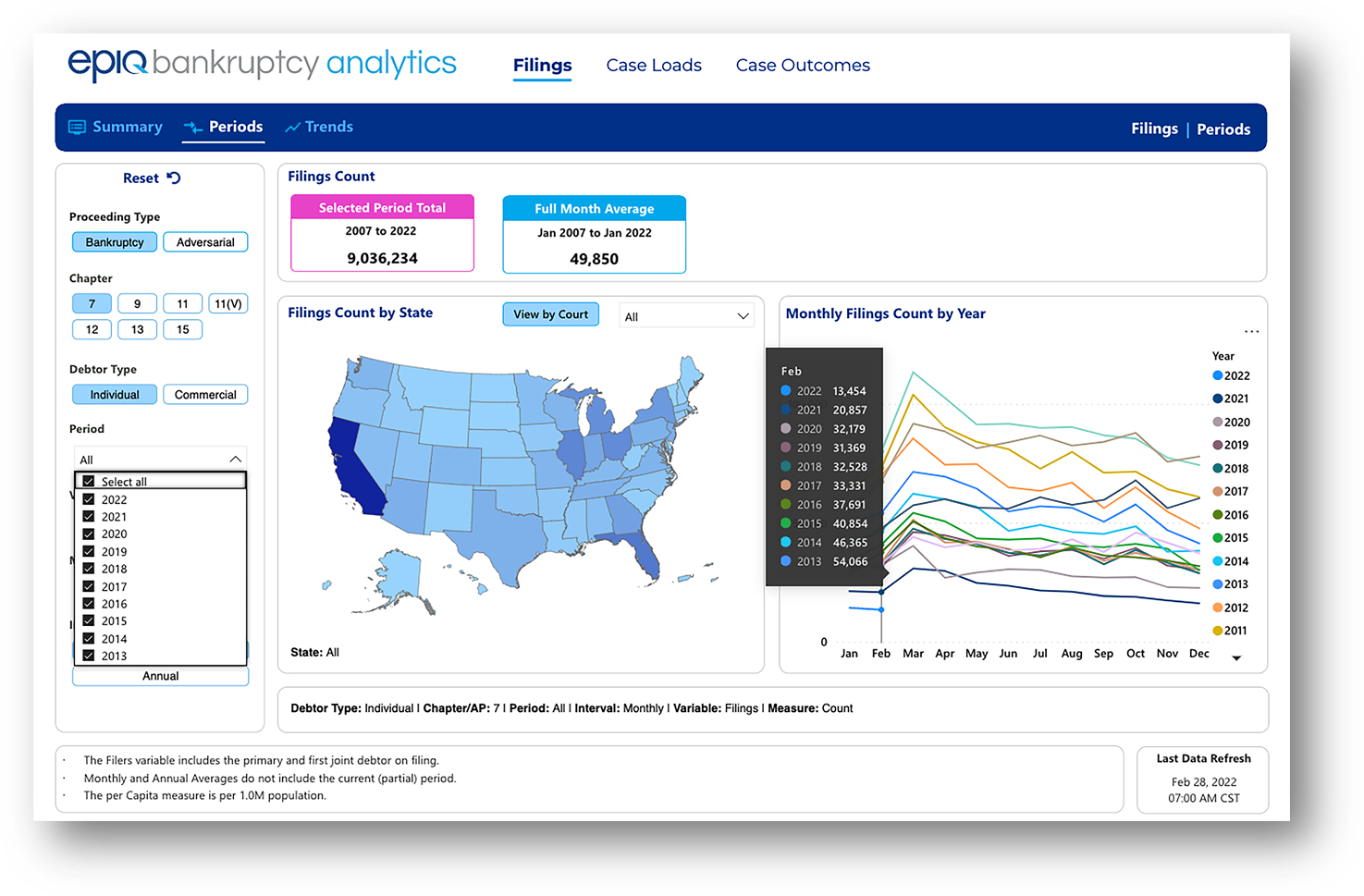

NEW YORK – MARCH 2, 2022 – Epiq, a global technology-enabled services leader to the legal industry, announced today from its Bankruptcy division the launch of the Epiq Bankruptcy Analytics web technology solution. This service provides legal and bankruptcy professionals with access to filing information, updated daily across 93 U.S. bankruptcy courts dating back to 2007, which gives users powerful, data-backed insights about the bankruptcy market.

Correlated with third-party data, Epiq Bankruptcy Analytics surfaces the industry’s most comprehensive dataset into a single, integrated platform through cloud-based dashboards that display:

- New and historical bankruptcy filing information with adversarial proceedings metrics for all bankruptcy chapters.

- Disposition metrics for discharge, dismissed and closed dates across states, courts, and chapters for selectable time periods.

- Case outcomes for closed case counts, duration, and rates.

Visibility into this rich bankruptcy dataset enables attorneys, creditors, investors, and other professionals in the bankruptcy industry a competitive advantage and allows them to make better decisions to grow their business. Users can monitor daily bankruptcy case counts by state, court, time, or geography to determine if filing metrics are increasing or decreasing. Users can right-size their business and budgets more effectively by leveraging historical data to identify data trends for predictive analysis by analyzing case disposition and duration metrics.

“We have been providing the bankruptcy market with monthly statistics for over 15 years,” said Chris Kruse, senior vice president of Epiq Bankruptcy. “As the country exits the global pandemic, there is a great deal of interest on bankruptcy filing rates. By moving to a daily update, users will be able to spot trends early. Now we’ve added business intelligence capability that unleashes the true value of this data by putting it in our clients’ hands whenever they need it so they can monitor metrics that matter most to them.”

“Responsive and data driven analytics dashboards are just the beginning,” said Todd Madsen, senior vice president of product at Epiq Bankruptcy. “The flexibility of the Epiq Bankruptcy platform’s deep dataset allows us to deliver ongoing enhancements to this solution that will continue to increase value to clients over time.”

Learn more or create an account to find out how Epiq Bankruptcy Analytics can help you discover insights, spot trends, and stay ahead of the curve.

About Epiq Bankruptcy

Epiq Bankruptcy is the largest provider of U.S. bankruptcy court data, technology and services, and a trusted partner to lenders, servicers, trustees, attorneys, investors, and other stakeholders operating in the business of bankruptcy. Epiq Bankruptcy solutions include comprehensive corporate restructuring, trustee case management, and access to the industry’s most dynamic bankruptcy data and analytics. Learn more at https://bankruptcy.epiqglobal.com/.

About Epiq

Epiq, a global technology-enabled services leader to the legal services industry and corporations, takes on large-scale, increasingly complex tasks for corporate counsel, law firms, and business professionals with efficiency, clarity, and confidence. Clients rely on Epiq to streamline the administration of business operations, class action and mass tort, court reporting, eDiscovery, regulatory, compliance, restructuring, and bankruptcy matters. Epiq subject-matter experts and technologies create efficiency through expertise and deliver confidence to high-performing clients around the world. Learn more at https://www.epiqglobal.com.

Press Contact

Angela Hoidas

Vice President, Marketing & Communications

Epiq

angela.hoidas@epiqglobal.com