Insurance

Industries

Applying expertise and technology to maximize claims efficiency and reduce costs.

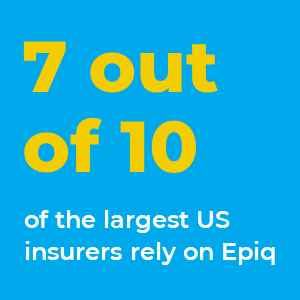

Epiq serves insurance carriers on a global scale, providing innovative and cost-effective discovery solutions as well as class action and mass tort lien resolution support. Our team is repeatedly selected by insurance carriers and panel counsel to provide solutions for a wide variety of claims, from single-custodian disputes to the most complex multi-district litigation matters. Seven out of 10 of the largest American insurance companies use Epiq, relying on our extensive suite of industry-serving solutions, worldwide presence and unmatched industry experience.

To leverage Epiq’s insurance services capabilities, reach out to Epiq's experts now

Get AssistanceEpiq is committed to improving and expanding the reach and depth of our Insurance Practice Group. Our team works to provide clients within the insurance industry with technology, experienced personnel, discounted rates and workflow solutions that will reduce the duration and costs for claims in the litigation cycle.

eDiscovery for Insurance

Many corporations carry insurance to assist with litigation costs, which means claims professionals are an important part of case budgeting. The budget usually allotted for discovery is more significant than ever before since modern litigation involves large amounts of data needing to be retrieved, reviewed, and disclosed. Budgets will only increase and become more complicated as new technologies become more prevalent and people continue to find new ways to communicate or create digital business content.

As such, it is important for insurance claims professionals to be cognizant of certain factors and procedures related to eDiscovery. While insurance professionals can not be expected to understand the technicalities or be experts in this area, having a baseline knowledge and education about eDiscovery will further help claims professionals during budget review and communications with outside counsel.

eDiscovery Technology

eDiscovery technology can be an invaluable tool used to cut down the time and costs involved with litigation. However, it is also a complex, multi-step process and comes with a variety of pricing models, ever-changing data sources and evolving technology solutions. At Epiq, we take the guesswork out of eDiscovery so your claims professionals and legal partners are able to concentrate on managing cases. We collaborate with insurance carriers, regardless of size, to build a bespoke playbook of best practices, adhering to each carrier’s desired processes and protocols.

Experience in a particular matter type is an important asset as we take a consultative approach when working with insurers, law firm partners, and the clients they serve. This experience means Epiq team members have access to proven workflows related to these matter types, and the ability to easily handle unusual but frequently associated data types. Our deep expertise spans a variety of litigation types commonly covered by insurers, including:

-

Errors and Omissions (E&O)

- Cyber Incident Response

- Directors & Officers (D&O)

- Employment Practice Liability Insurance (EPLI)

- Energy

- Construction Defect

- Environmental

- Product Liability

Our team works to provide a full suite of end-to-end discovery offerings to support insurance clients, including forensic data collection, ESI processing, hosting, predictive coding, project management and discovery product services. We also offer highly structured support for the review of documentation related to inquiries, investigations and litigation as well as court reporting and deposition services. Our Insurance Practice Group’s extensive experience in supporting the insurance industry’s eDiscovery needs is a key reason why Epiq is repeatedly selected by carriers and panel counsel to manage discovery services for claims of all types.

Class Action and Mass Tort Services for Insurance Matters

Epiq provides the resources to resolve health care liens for the largest settlements as well as the compassion, skill and discretion to handle the most delicate cases, allowing our clients to rely on us as a key partner in large-scale insurance class action settlements. Our administrative services incorporate innovation, quality and speed of execution with an unwavering commitment to privacy and data security to meet all of our clients’ needs.

As the largest class action settlement provider in the market, Epiq has the team and technology available to provide a number of important back-office services for insurance matters that require the coordination of outreach, communication and the distribution of funds. Our team manages the processing and review of insurance claims for clients reliably and efficiently, and is also able to make eligibility determinations and payment calculations.

The accuracy of our review sets us apart and, in recent years, eight independent audits of our largest cases have found our group to be at least 99.7% accurate every time. Our claims review specialists are specifically trained for the most complex needs related to claim validation, auditing and processing, including extensive medical records.

Our expert consultants partner with your organization to collaborate and develop a comprehensive project plan, define repeatable procedures and assemble a dedicated case team to implement your unique action plan. Clients will also have immediate access to a dedicated Epiq team leader to handle any challenges throughout the project execution as we strive to offer the highest level of client service and transparency.

At Epiq, we have the resources and capability to resolve health care liens asserted by:

-

Medicare Parts A and B

-

Medicare Part C

-

State Medicaid

-

Military or other governmental health care

-

Private insurers

-

Other health plans as determined by individual case

Innovating the Claim Process

As industry leaders within the insurance sector, our team provides clients with the best combination of people, processes and technology to take a claim from collection through review, regardless of the size of the organization or complexity of the case. We collaborate with insurers throughout the process to build and implement workflows that match the individual needs of our clients and will work to closely align ourselves to each organization's own desired processes and protocols. Ultimately, this helps claims professionals quickly initiate and engage with Epiq on new matters and deliver results.

Our technology-backed approach to the claim process ensures a consistent, legally defensible result that can be replicated across numerous matters and needs. Our clients experience cost savings while having the peace of mind that their sensitive information is protected.

Contact our Insurance Practice Group to learn more about how our team can work to reduce the time and resources your organization invests in the litigation cycle.

Take the First Steps with

Epiq is the global leader in technology-enabled legal services, corporate restructuring, cyber security and business transformation solutions.