Automatic Bankruptcy

Filing Notifications

Filing Notifications

Automatic, daily matching and notification of bankruptcy filings within your debtor portfolios.

Our approach to automatic bankruptcy noticing makes it easy to monitor every new bankruptcy filing or petition bankruptcy, enabling timely responses and reducing risk. By leveraging this daily service, you can better prepare for bankruptcy proceedings, handle file notice obligations, and ensure compliance with the bankruptcy code when you need to pay debts or file proof claim. Additionally, you can automate credit counseling verifications and stay fully aware of relevant court bankruptcy activity and legal advice requirements, helping avoid missed deadlines or overlooked updates.

Identify New Bankruptcies

By focusing on each bankruptcy chapter, our solution helps you track whether a debtor bankruptcy occurs under chapter bankruptcy. This oversight includes the possibility of a debtor discharge or any pre petition debt concerns, ensuring no vital information is missed. You can also stay updated on new bankruptcies that might involve a bankruptcy trustee and manage important steps like filing bankruptcy or addressing any potential automatic stay conflicts. Through notification bankruptcy insights, you can quickly evaluate whether debts discharged in one jurisdiction might impact your portfolio in another federal court region

Nightly Searches

Provide AACER your debtor portfolio with all asset types. After nightly searching all U.S. Bankruptcy Courts for new filers, AACER matches them against your debtor portfolio. The new filer results are available within a queue in the AACER platform to review and approve, are sent by SFTP directly into your servicing system or third-party application, or other.

- This thorough nightly matching includes checking for any bankruptcy debtor across all bankruptcy court districts to verify if a bankruptcy petition has been filed.

- Our process also monitors any changes in stay bankruptcy status and detects newly filed bankruptcy alerts so you can respond quickly.

- Whether it’s a chapter bankruptcy alert or pre petition indicators, you can rest assured that your team is fully informed about every relevant court proceeding and can file bankruptcy responses or notices as needed.

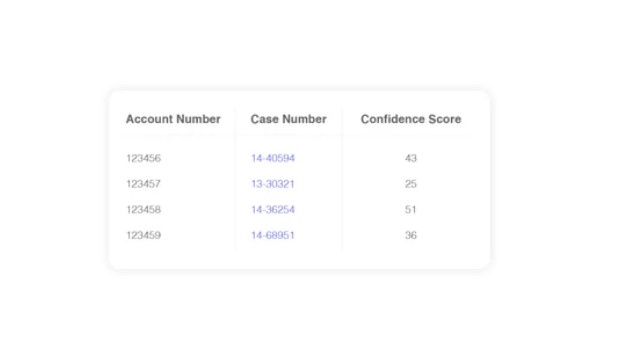

Filer Matches and Confidence Score

Searches can be by full or last four Social Security number, case number, loan number or name. AACER includes a proprietary “Confidence Score” in the returned results that communicates the match-confidence level to each filer.

- This approach ensures you have a precise view of bankruptcy filed details, such as a newly filed bankruptcy notice or changes within a bankruptcy chapter.

- It helps preempt confusion around petition bankruptcy cases or the conditions of debtor discharge.

- You can also quickly gather the data needed to file proof claim documentation or evaluate potential pre petition debt.

- This makes it simpler to stay on top of filing bankruptcy requirements and handle any emerging bankruptcy debtor alert promptly.

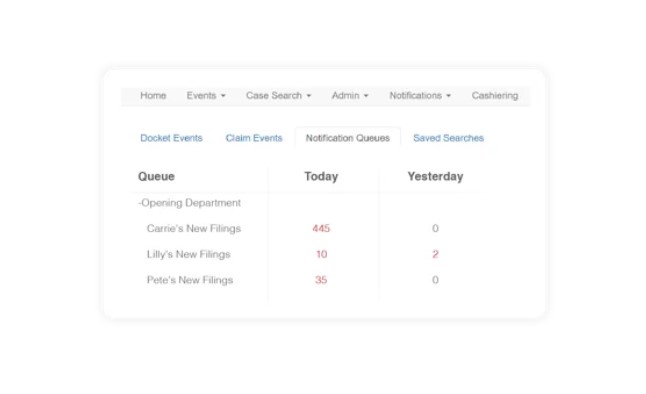

Notification Queues

New filer matches can be loaded into notification queues and distributed, allowing users to review and approve new cases directly within the AACER platform. Approved new cases can then be setup in servicing systems or other third-party applications.

- AACER queues provide users a way to proactively organize new commercial and individual filings by using specific data elements such as Confidence Score, date filed, or chapter to identify and acknowledge the new bankruptcies.

- Supervisors can configure queues, monitor user progress and, if necessary, quickly reallocate workloads.

Whether you’re dealing with a debtor who filed bankruptcy recently or overseeing court bankruptcy communication, these notification queues equip you with every bankruptcy notice, including electronic bankruptcy noticing, so you can swiftly adapt your workflow. You also have tools to investigate stay bankruptcy statuses and confirm whether strategic actions—like requesting legal advice or processing particular bankruptcy alert conditions—are necessary. Plus, you can receive email updates that document every files bankruptcy event relevant to your organization.

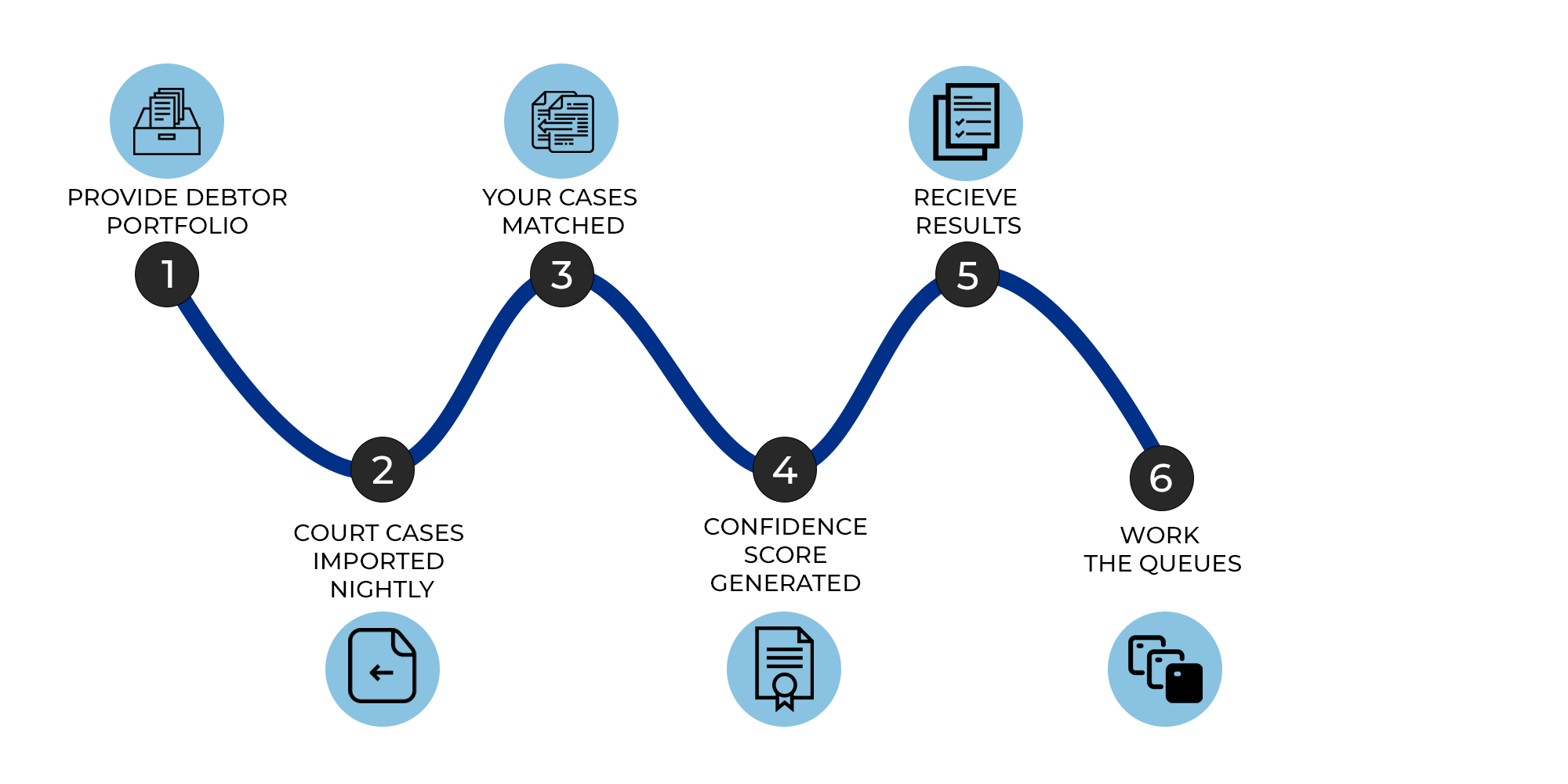

How it Works

By leveraging our electronic bankruptcy solutions, you can avoid missing any critical notice bankruptcy from the federal court and ensure debts discharged or automatic stay requests do not go unnoticed

- Our system tracks the finer details—from the bankruptcy code specifics to pre petition data—so you can handle complex cases without worrying about lost information.

- This comprehensive approach simplifies your operations, allowing you to file notice or respond to a bankruptcy debtor in a timely manner, and helps mitigate risks tied to any chapter bankruptcy changes.

Get in Touch with Epiq Bankruptcy and get answers to your questions and find out how our offerings can help your business.