Cashiering

and Payment Matching

Auto-match Trustee checks or vouchers to your portfolio and eliminate manual identification.

Eliminate errors from manual payment processing, cost and risk associated with misapplication of Trustee payments.

Download Handout ->>>

Get in Touch with Epiq Bankruptcy and get answers to your questions and find out how our offerings can help your business.

Trustee Voucher Payment Matching

AACER’s CashieringTM solution obtains Trustee payment disbursement details from the National Data Center (NDC) and matches it to your loan portfolio, thus eliminating errors from manual processing, as well as reducing the cost and risk associated with misapplication of Trustee payments.

Automated Matching

AACER dynamically matches the payment vouchers with the corresponding accounts in the customer portfolio and displays both the aggregated Trustee vouchers and payment details in a single view.

Expedited Payment Posting

Assist in the identification to quickly and accurately apply payments to correct loans, even when there are multiple filers within the Trustee payment.

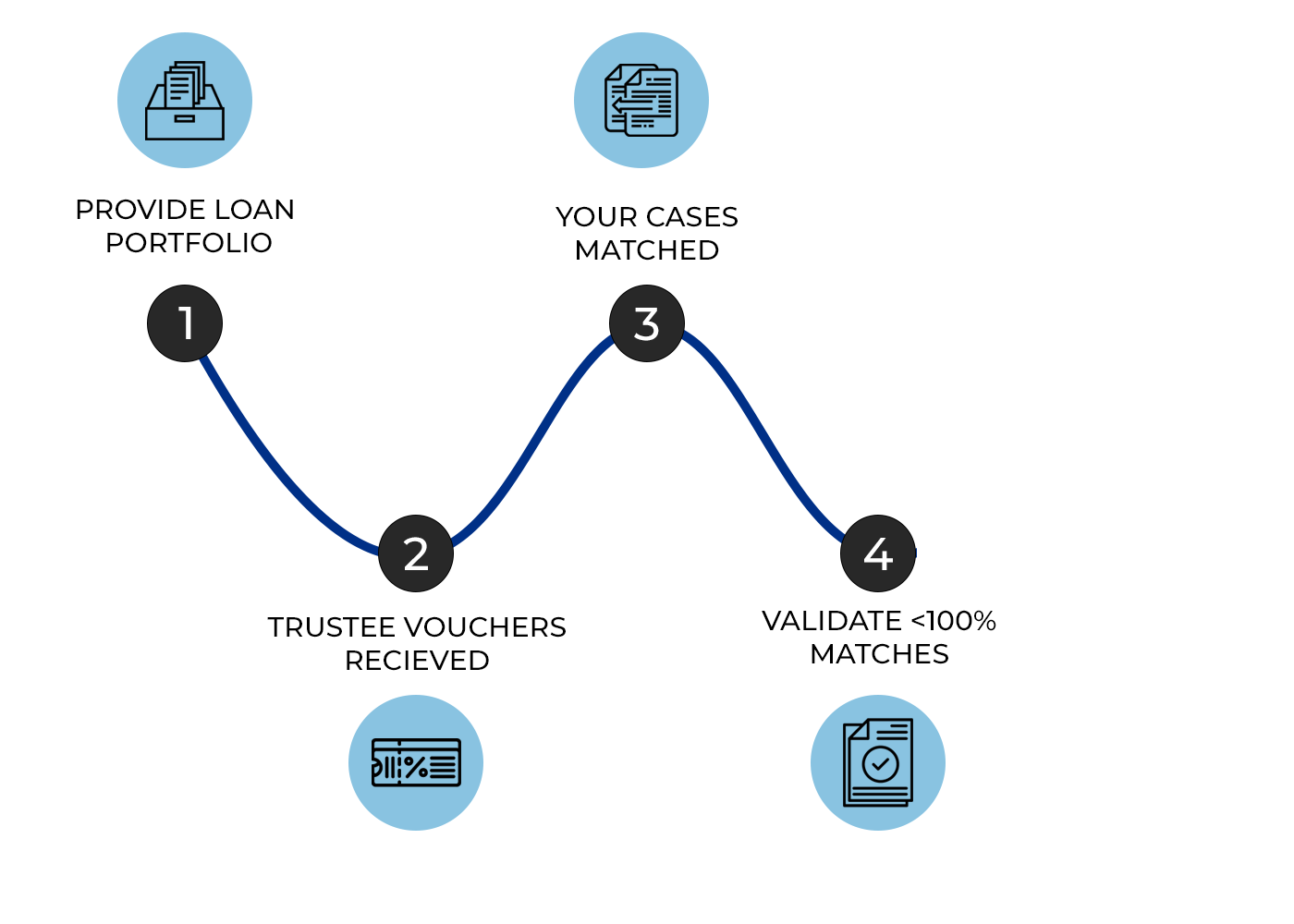

How it Works

.png)

Get in Touch with Epiq Bankruptcy and get answers to your questions and find out how our offerings can help your business.